What is a Managed Filing

A managed filing is when one of our dedicated accountants completes your company’s filings on your behalf, based on the year-end figures provided.

What information we require to complete your Managed Filing

To be able to complete your managed filing we will need the following information:

- An Income statement and Balance sheet (if you are using a Book-keeping software);

- An Excel spreadsheet covering income and expenditure, if thats how you record your business transactions

- Bank statements covering the full accounting period;

- A copy of your previous year accounts (if this is not your first year).

On receipt of this information, we will prepare your CT600 tax return and associated computations, along with your accounts tagged in the required iXBRL. Your full accounts will be submitted to HMRC and your abridged account will be sent to Companies House.

WHilst preparing your filings, if we need any further information we will email. Once your filings have been completed, you will be asked for a review and if you are happy – we will then submit to HMRC and Companies House. We will provide you with a full explanation of how we calculated any tax due and allowances claimed. You will be able to download all your submitted documentation for your records.

We currently offer Managed Filings for:

Dormant Companies

If your company has not been trading in the accounting period you are filing for, then your company qualifies as dormant. If HMRC has been informed that the company is dormant, and you have not received a notice to deliver a corporation tax return, then you will not be asked to submit return to HMRC.

On the other hand, despite the dormant state of your company - Companies House expects abridged accounts to be submitted every year.

The dormant managed filing service includes: Completion of dormant abridged accounts to Companies House. *If you have received a notice to file a CT600 to HMRC, then this will be included too*

Trading Micro Sized Companies

If your company is trading and qualifies as micro, then you can use our micro managed filing service.

Your company qualifies as Micro if two of the following apply:

- Turnover of £632k or less

- Balance sheet total of £316k or less

- 10 Employees or less

This service includes: Completion of full set of accounts (Income statement and Balance sheet in FRS 105) and a corporation tax return -CT600. In the case of an extended period two CT600 will be submitted to HMRC. Additionally, includes filing of abridged accounts to Companies House.

Trading Small Sized Companies

If your company is trading and qualifies as small, then you can use our small managed filing service. Your company qualifies as Small if two of the following apply:

- Turnover of £10.2 million or less

- Balance sheet total of £5.1 million or less

- 50 Employees or less

This service includes: Completion of full set of accounts (Income statement and Balance sheet in FRS103) and a corporation tax return -CT600. Also, includes filing of abridged accounts to Companies House

How to get Started:

It is now time to set up an account with Easy Digital Tax. You will need to search for your company’s name, then provide your email address and lastly, set up a password. You can create an account or log in here

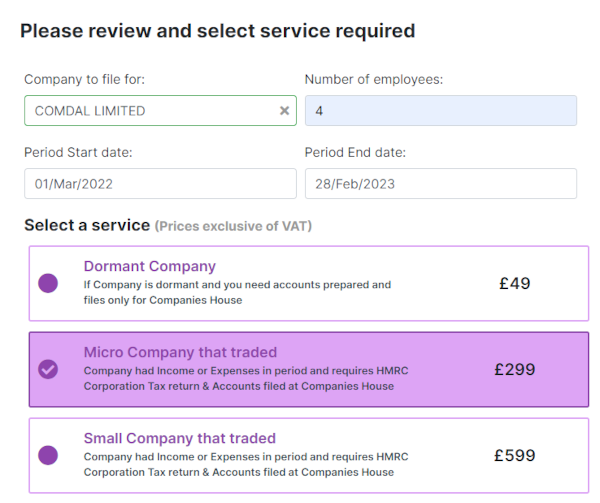

Once logged in you will be taken directly to the page to enter in your company name, number of employees as well as the accounting period you wish to file for:

When the details above are completed, please select the Managed filing service which you require and simply click on Next which will take ypu to the payment screen.

Once paid, the next stage will be providing some further information which will be of a great assistance to complete your company’s filings, these include your company UTR and your Companies House authentication code.

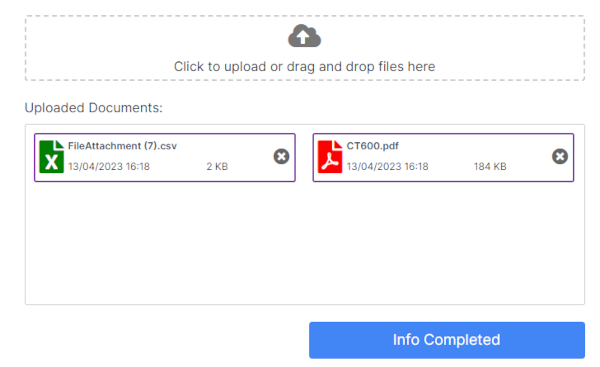

On this screen you will also be able to upload your supporting documentation:

After you have completed all the steps on the page you can double check your details once again and then click on ‘Info Completed’.

You are all done! Your Managed filing will be assigned to one of our accounting specialists’ team who will review the information provided and start working on your Managed filing case. Our working hours are from 8:30 to 17:30 Monday to Friday, therefore your managed filing case will be assigned in this timeframe. If there are any further details required in order to complete your filings - we will contact you. Once your filings have been completed, you will be asked to review and when you are satisfied – we will submit to HMRC and Companies House. We understand that filing accounts can be a stressful process, so we will be more than happy to assist you and answer any questions you may have.